1、 Market Overview and Trends

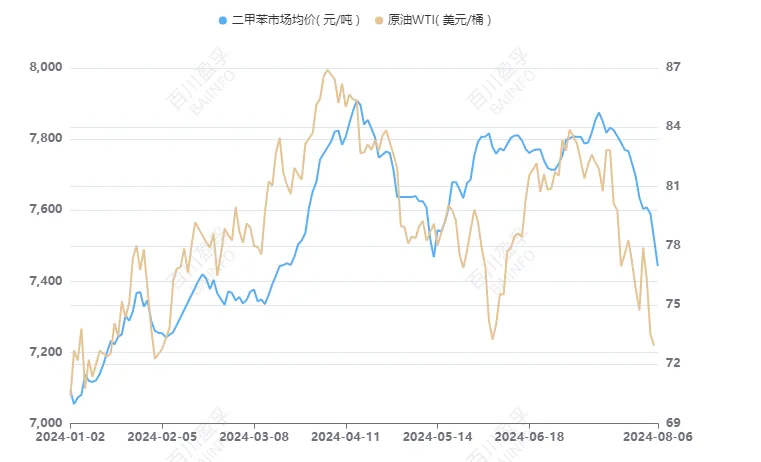

Since mid July, the domestic xylene market has undergone significant changes. With the weak downward trend in raw material prices, previously shut down refinery units have been put into production, while downstream industry demand has not been effectively matched, resulting in a weak supply and demand fundamentals. This trend has directly driven the continuous decline of the xylene market in various regions of China. The terminal prices in East China have fallen to 7350-7450 yuan/ton, a decrease of 5.37% compared to the same period last month; The Shandong market was also not spared, with prices ranging from 7460-7500 yuan/ton, a drop of 3.86%.

2、 Regional market analysis

1. East China region:

Entering August, the continuous decline in international oil prices has further exacerbated the weakness of the raw material side, while downstream chemical industries such as solvents are in a traditional off-season with weak demand. In addition, the expected increase in xylene imports has also intensified market supply pressure. Holders of goods generally hold a bearish attitude towards the future market, and the spot prices at the port continue to decline, even falling below the market prices in Shandong at one point.

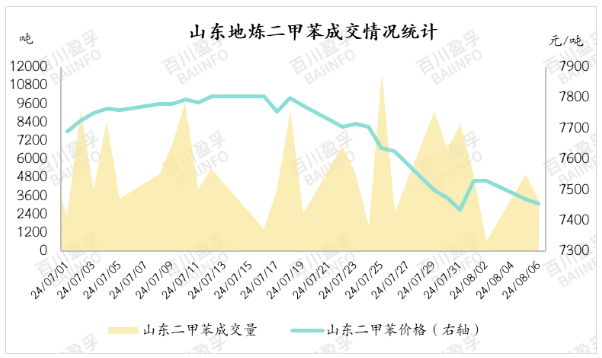

2.Shandong region:

The rapid price increase in the early stage of Shandong region has made it difficult for downstream customers to accept high priced goods, resulting in a low willingness to replenish. Although some refineries have adopted price reduction and promotion strategies, there has been no significant boost in the downstream oil blending field, and market demand is still dominated by essential needs. As of August 6th, the total shipment volume of non long-term cooperative sample enterprises in Shandong refining was only 3500 tons, and the transaction price remained between 7450-7460 yuan/ton.

3.South and North China regions:

The market performance in these two regions is relatively stable, with spot goods mostly sold through contracts, resulting in a tight supply of available goods. The market quotation fluctuates with the listing price of refineries, with prices in the South China market ranging from 7500-7600 yuan/ton and the North China market ranging from 7250-7500 yuan/ton.

3、 Future prospects

1.Supply side analysis:

After entering August, the maintenance and restart of domestic xylene plants coexist. Although some refinery units are scheduled for maintenance, the units that were shut down earlier are expected to be gradually put into production, and there is an expectation of increased imports. Overall, the restart capacity is greater than the maintenance capacity, and the supply side may show an incremental trend.

2.Demand side analysis:

The downstream oil blending field maintains the demand for essential purchases and delivers more existing orders, while the overall downward trend of PX continues. The PX-MX price difference has not reached a profitable level, resulting in the main demand for external xylene extraction. The support for xylene on the demand side is clearly insufficient.

3.Comprehensive analysis:

Under the guidance of weak supply and demand fundamentals, the support for the raw material side xylene market is limited. There are currently no significant positive factors supporting the market on the news front. Therefore, it is expected that the domestic xylene market will maintain a weak trend in the later stage, with prices easily falling but difficult to rise. Preliminary estimates suggest that prices in the East China market will fluctuate between 7280-7520 yuan/ton in August, while prices in the Shandong market will be between 7350-7600 yuan/ton.

Post time: Aug-07-2024