1、 MMA market prices hit a new high

Recently, the MMA (methyl methacrylate) market has once again become the focus of the industry, with prices showing a strong upward trend. According to Caixin News Agency, in early August, several chemical giants including Qixiang Tengda (002408. SZ), Dongfang Shenghong (000301. SZ), and Rongsheng Petrochemical (002493. SZ) raised MMA product prices one after another. Some companies even achieved two price increases in just one month, with a cumulative increase of up to 700 yuan/ton. This round of price increase not only reflects the tight supply and demand situation in the MMA market, but also indicates a significant improvement in the industry’s profitability.

2、 Export growth becomes a new engine of demand

Behind the booming MMA market, the rapid growth of export demand has become an important driving force. According to a large petrochemical enterprise in China, although the overall capacity utilization rate of MMA plants is low, the strong performance of the export market effectively compensates for the shortage of domestic demand. Especially with the stable growth of demand in traditional application fields such as PMMA, the export volume of MMA has significantly increased, bringing additional demand growth to the market. Customs data shows that from January to May this year, the cumulative export volume of methyl methacrylate in China reached 103600 tons, a significant increase of 67.14% year-on-year, indicating a strong demand for MMA products in the international market.

3、 Capacity constraints exacerbate supply-demand imbalance

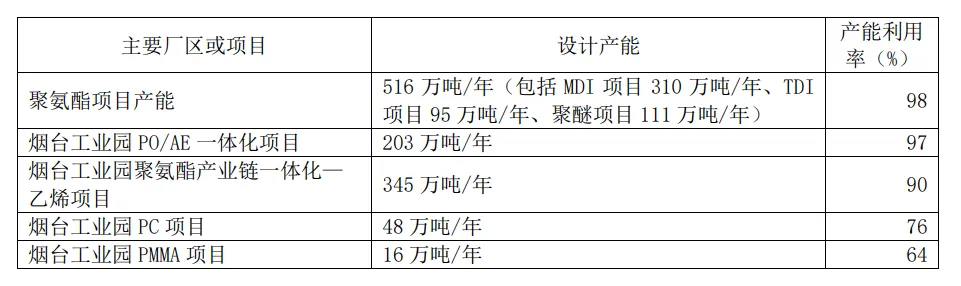

It is worth noting that despite strong market demand, MMA production capacity has not kept up with the pace in a timely manner. Taking the Yantai Wanhua MMA-PMMA project as an example, its operating rate is only 64%, far lower than the full load operation state. This situation of limited production capacity further exacerbates the supply-demand imbalance in the MMA market, causing product prices to continue to rise driven by demand.

4、 Stable costs boost soaring profits

While the price of MMA continues to rise, its cost side remains relatively stable, providing strong support for the improvement of the industry’s profitability. According to data from Longzhong Information, the price of acetone, the main raw material for MMA, has fallen to the range of 6625 yuan/ton to 7000 yuan/ton, which is basically the same as the same period last year and still at a low level for the year, with no signs of stopping the decline. In this context, the theoretical profit of MMA using ACH process has significantly increased to 5445 yuan/ton, an increase of about 33% compared to the end of the second quarter, and 11.8 times the theoretical profit of the same period last year. This data fully demonstrates the high profitability of the MMA industry in the current market environment.

5、 Market prices and profits are expected to remain high in the future

The MMA market is expected to maintain its high price and profit trend in the future. On the one hand, the dual factors of domestic demand growth and export drive will continue to provide strong demand support for the MMA market; On the other hand, against the backdrop of stable and fluctuating raw material prices, the production cost of MMA will be effectively controlled, thereby further consolidating its high profitability trend.

Post time: Aug-19-2024