1、 Market Overview

Recently, after nearly two months of continuous decline, the decline in the domestic acrylonitrile market has gradually slowed down. As of June 25th, the domestic market price of acrylonitrile has remained stable at 9233 yuan/ton. The early decline in market prices was mainly due to the contradiction between increased supply and relatively weak demand. However, with the maintenance of some devices and the increase in raw material costs, acrylonitrile manufacturers have begun to show strong willingness to raise prices, and there are signs of market stability.

2、 Cost analysis

The recent high volatility trend in the raw material propylene market has provided strong support for the cost of acrylonitrile. Entering June, some external PDH propylene units experienced occasional maintenance leading to local supply shortages, which in turn drove up propylene prices. At present, the price of propylene in the Shandong market has reached 7178 yuan/ton. For acrylonitrile factories that outsource raw materials, the cost of propylene raw materials has increased by about 400 yuan/ton. Meanwhile, due to the continuous decline in acrylonitrile prices, production gross profit has significantly decreased, and some products have already shown a loss making state. The increasing cost pressure has strengthened the willingness of acrylonitrile manufacturers to enter the market, and the industry’s capacity utilization rate has not been further improved. Some devices have started to operate under reduced load.

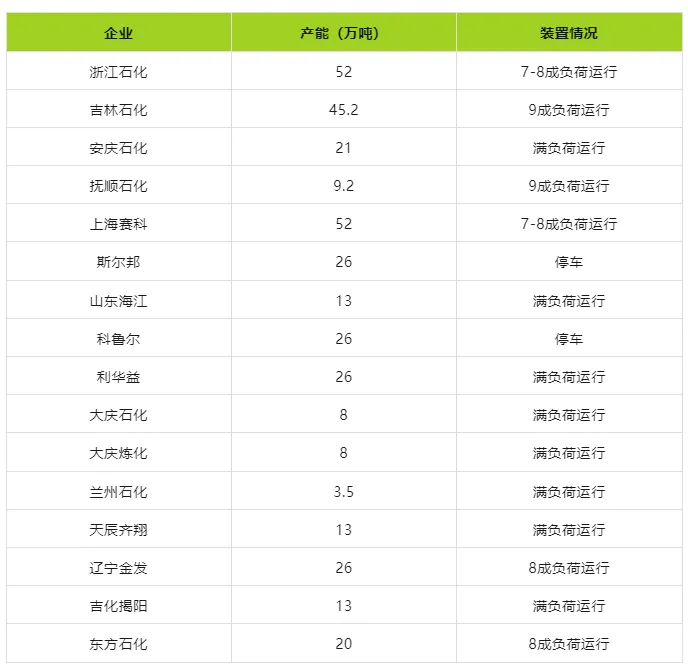

3、 Supply side analysis

In terms of supply, recent maintenance of some devices has eased the market supply pressure. On June 6th, the 260000 ton acrylonitrile unit in Korul was shut down for maintenance as scheduled. On June 18th, a 260000 ton acrylonitrile unit in Selbang was also shut down for maintenance. These maintenance measures have once again lowered the capacity utilization rate of the acrylonitrile industry to below 80%, currently around 78%. The reduction in production has effectively alleviated the pressure of oversupply of acrylonitrile, making factory inventory controllable and providing manufacturers with the motivation to raise prices.

4、 Demand side analysis

From the perspective of downstream consumer markets, demand is still weak at present. Although the domestic supply of acrylonitrile has increased since June, and downstream consumption has also increased month on month, the overall operating rate is still at a low level, with limited support for acrylonitrile prices. Especially after entering the off-season, the growth trend of consumption may be difficult to continue and show signs of weakening. Taking ABS equipment as an example, the average operating rate of ABS equipment in China recently was 68.80%, a month on month decrease of 0.24%, and a year-on-year decrease of 8.24%. Overall, the demand for acrylonitrile remains weak, and the market lacks sufficient and effective rebound momentum.

5、 Market Outlook

Overall, the domestic propylene market will maintain a high operating trend in the short term, and cost support still exists. In the latter half of the year, many business owners will observe the settlement situation of large acrylonitrile factories, and on-site procurement will mainly maintain rigid demand. In the absence of obvious news to boost, the trading center of the acrylonitrile market is expected to remain relatively stable. It is expected that the mainstream negotiated price for self pickup of cans from East China ports will fluctuate around 9200-9500 yuan/ton. However, considering the weak downstream demand and supply pressure, there are still uncertain factors in the market, and it is necessary to closely monitor industry dynamics and changes in market demand.

Post time: Jun-27-2024