1、 Market Overview: PTA Prices Set a New Low in August

In August, the PTA market experienced a significant wide decline, with prices hitting a new low for 2024. This trend is mainly attributed to the significant accumulation of PTA inventory in the current month, as well as the difficulty in effectively alleviating the problem of inventory backlog in the absence of large-scale equipment shutdown and production reduction. Meanwhile, the decline in the international crude oil market has failed to provide effective cost support for PTA, further exacerbating its downward pressure on prices.

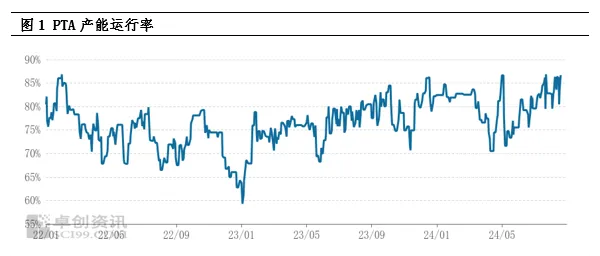

2、 Supply side analysis: High production capacity running, inventory reaching new highs

Currently, the PTA production capacity operation rate remains at a high level, and the supply of goods is extremely abundant. Since 2024, PTA monthly production has significantly increased compared to the same period last year and is expected to reach a historic high. This high production directly led to a new high in PTA social inventory, becoming a key factor in suppressing spot prices. Although the high operating rate of the downstream polyester industry has to some extent slowed down the accumulation of PTA inventory, without the centralized maintenance and production reduction of large-scale PTA plants, the situation of oversupply is difficult to reverse, and the market holds a pessimistic attitude towards the future trend of PTA.

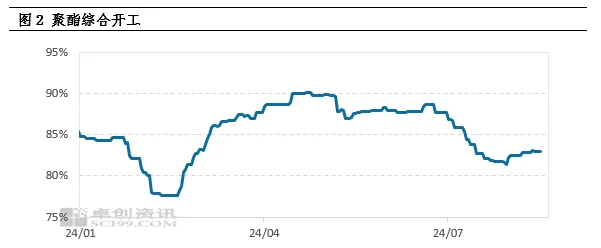

3、 Demand side analysis: Demand falls short of expectations, polyester production starts at a low level

The weakness on the demand side is another important reason for the decline in PTA prices. The continuous increase in polymerization costs in the early stage has led to a decline in profits for polyester products, forcing some polyester factories to adopt a strategy of reducing production and raising prices. This chain reaction has led to a continuous decline in polyester production rates, and in August, most polyester factories joined the ranks of reducing production, resulting in a significant decrease in PTA demand. The low willingness of polyester factories to receive goods is mainly due to the consumption of inventory and long-term contract sources, further exacerbating the supply-demand imbalance of PTA.

4、 Inventory pressure and market expectations

Based on the current supply and demand situation, PTA is expected to accumulate about 300000 tons in August, resulting in a wide decline in prices. Looking ahead, the supply pressure in the PTA market remains enormous, mainly due to limited centralized maintenance facilities and the fact that most large facilities have completed maintenance within the year. It is expected that the monthly PTA production will remain at a high level of over 6 million tons per month in the future. Even if downstream polyester production starts to rebound, it will be difficult to fully digest such high production, and supply pressure will continue to exist.

5、 Cost support and weak oscillation pattern

Despite facing many negative factors in the market, the international crude oil market still provides some cost support for PTA. At the macro level, concerns about a global economic recession have led to a general decline in commodity prices, but the rising expectation of interest rate cuts has brought a touch of warmth to the market. On the supply side, the uncertainty of geopolitical risks and OPEC+’s production reduction policy continue to affect the oil market. On the demand side, the expectation of crude oil destocking still exists. Under the combined effect of these factors, the oil market presents a situation of mixed long and short positions, with PTA processing fees fluctuating between 300-400 yuan/ton. Therefore, despite the enormous supply pressure, the cost support of international crude oil may still lead to a weak and volatile pattern in the PTA market.

6、 Conclusion and Prospect

In summary, the PTA market will face significant supply pressure in the future, and the weak demand side will further exacerbate the market’s pessimistic sentiment. However, the cost support role of international crude oil cannot be ignored, which may to some extent slow down the decline in PTA prices. Therefore, it is expected that the PTA market will enter a period of weak volatility.

Post time: Aug-26-2024