1. Price Analysis

Phenol market:

In June, phenol market prices showed an overall upward trend, with the monthly average price reaching RMB 8111/tonne, up RMB 306.5/tonne from the previous month, a significant increase of 3.9%. This upward trend is mainly attributed to the tight supply in the market, especially in the northern region, where supplies are particularly scarce, with plants in Shandong and Dalian overhauling, leading to a reduction in supply. At the same time, BPA plant load started higher than expected, the consumption of phenol significantly increased, further exacerbating the contradiction between supply and demand in the market. In addition, the high price of pure benzene at the raw material end also provided strong support for phenol prices. However, at the end of the month, phenol prices turned slightly weaker due to the long-term losses of BPA and the expected turnaround of pure benzene in July-August.

Acetone market:

Similar to the phenol market, the acetone market also showed a slight upward trend in June, with a monthly average price of RMB 8,093.68 per tonne, up RMB 23.4 per tonne from the previous month, a smaller increase of 0.3%. The rise of acetone market was mainly attributed to the trading sentiment turning favourable due to the anticipation of the industry on the centralised maintenance in July-August and the reduction of imported arrivals in the future. However, as downstream terminals were digesting pre-stockpiling and demand for small solvents declined, acetone prices started to weaken towards the end of the month, dropping to around RMB 7,850/mt. Acetone’s self-contained speculative attributes also led to the industry focusing on bullish stocks, with terminal inventories rising significantly.

2.supply analysis

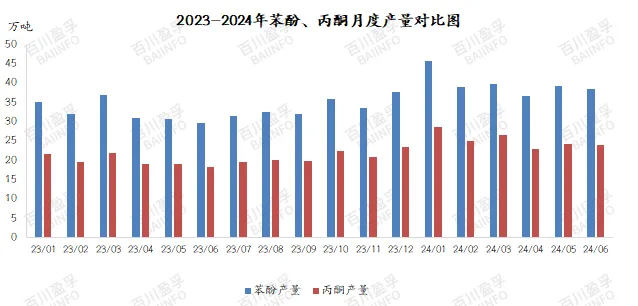

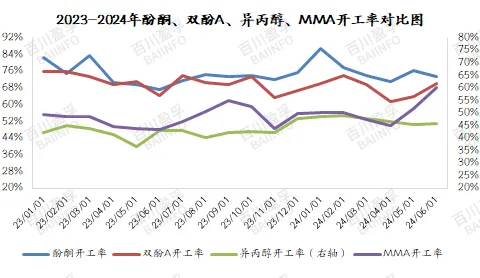

In June, the output of phenol was 383,824 tonnes, down 8,463 tonnes from a year earlier; the output of acetone was 239,022 tonnes, down 4,654 tonnes from a year earlier. Phenol and ketone enterprises’ start-up rate declined, the industry start-up rate was 73.67% in June, down 2.7% from May. The downstream start-up of Dalian plant gradually improved, reducing the release of acetone, further affecting the market supply.

Third, demand analysis

Bisphenol A plant’s June start rate rose significantly to 70.08%, up 9.98% from May, providing strong support to the demand for phenol and acetone. The start rate of phenolic resin and MMA units also increased, up 1.44% and 16.26% YoY respectively, showing positive changes in downstream demand. However, the start rate of isopropanol plant rose 1.3% YoY, but the overall demand growth was relatively limited.

3.Inventory situation analysis

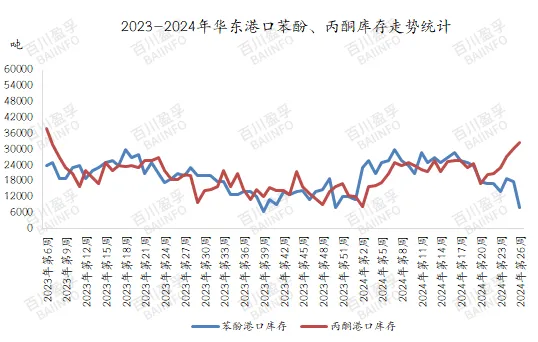

In June, phenol market realised de-stocking, both factory stock and Jiangyin port stock declined, and returned to normal level at the end of the month. In contrast, the port inventory of acetone market has accumulated and is at a high level, showing the status quo of relatively abundant supply but insufficient demand growth in the market.

4.Gross profit analysis

Influenced by the increase in raw material prices, East China phenol ketone single tonne cost increased by 509 yuan / tonne in June. Among them, the listed price of pure benzene in the beginning of the month pulled up to 9450 yuan / tonne, a petrochemical company in East China, the average price of pure benzene rose 519 yuan / tonne compared with May; the price of propylene also continued to rise, the average price of 83 yuan / tonne higher than in May. However, despite the rising costs, phenol ketone industry is still facing a loss situation, the industry in June, a loss of 490 yuan / tonne; bisphenol A industry monthly average gross profit is -1086 yuan / tonne, showing the weak profitability of the industry.

To sum up, in June, phenol and acetone markets showed different price trends under the dual role of supply tension and demand growth. In the future, with the end of plant maintenance and changes in downstream demand, market supply and demand will be further adjusted and price trends will fluctuate. Meanwhile, the continuous increase of raw material prices will bring more cost pressure to the industry, and we need to pay close attention to the market dynamics to cope with the potential risks.

Post time: Jul-04-2024