1、 Changes in industry gross profit and capacity utilization rate

This week, although the average gross profit of the bisphenol A industry is still in the negative range, it has improved compared to last week, with an average gross profit of -1023 yuan/ton, a month on month increase of 47 yuan/ton, and a growth rate of 4.39%. This change is mainly due to the relatively stable average cost of the product (10943 yuan/ton), while the market price fluctuations are relatively small. At the same time, the capacity utilization rate of domestic bisphenol A plants has significantly increased to 71.97%, an increase of 5.69 percentage points from last week, indicating the strengthening of industry production activities. Based on a production capacity base of 5.931 million tons, this increase reflects the enhancement of market supply capacity.

2、 Spot market trend differentiation

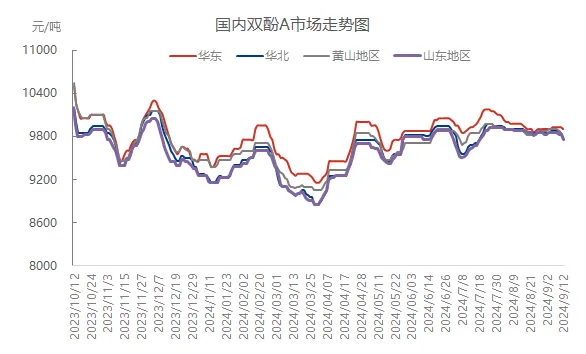

This week, the spot market for bisphenol A showed obvious regional differentiation characteristics. Although major manufacturers in the East China market attempted to raise prices, actual transactions were mainly based on digesting previous contracts, resulting in a bearish trend in prices. As of the close on Thursday, the mainstream negotiated price range was 9800-10000 yuan/ton, which was slightly lower than last Thursday. In other regions such as Shandong, North China, Mount Huangshan and other places, due to weak demand and market mentality, prices generally fell by 50-100 yuan/ton, and the overall market atmosphere was weak.

3、 Comparison of National and Regional Market Prices

This week, the average price of bisphenol A in China was 9863 yuan/ton, a slight decrease of 11 yuan/ton compared to the previous week, with a decrease of 0.11%. Specifically in the regional market, the East China region has shown relatively resistance to decline, with an average price increase of 15 yuan/ton month on month to 9920 yuan/ton, but the increase is only 0.15%; However, North China, Shandong, Mount Huangshan and other places experienced different degrees of decline, ranging from 0.10% to 0.30%, showing the differences in regional markets.

Picture

4、 Analysis of Market Influencing Factors

Capacity utilization rate improvement: This week, the capacity utilization rate of bisphenol A reached around 72%, further enhancing market supply capacity and putting pressure on prices.

International crude oil crash: The significant drop in international crude oil prices not only affects the overall mentality of the petrochemical industry chain, but also directly affects the price trend of raw materials such as phenol and acetone, which in turn has a negative impact on the cost support of bisphenol A.

Downstream demand is sluggish: The downstream epoxy resin and PC industries are experiencing losses or approaching breakeven, and the purchasing demand for bisphenol A remains cautious, resulting in sluggish market transactions.

5、 Market forecast and outlook for next week

Looking ahead to next week, with the restart of maintenance equipment and the stabilization of production, the domestic supply of bisphenol A is expected to further increase. However, the downstream industry has limited room for load fluctuations, and it is expected that the procurement of raw materials will maintain a level of essential demand. At the same time, the raw material side phenol and acetone markets may enter a volatile pattern, providing certain cost support for bisphenol A. However, considering the overall weakening of market sentiment, it is necessary to closely monitor the production and sales situation of major manufacturers and the fluctuations in the upstream and downstream markets next week. It is expected that the market will show a narrow weak consolidation trend.

Post time: Sep-13-2024