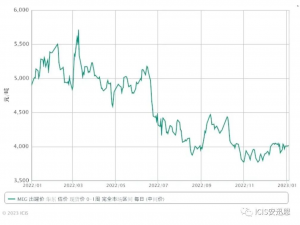

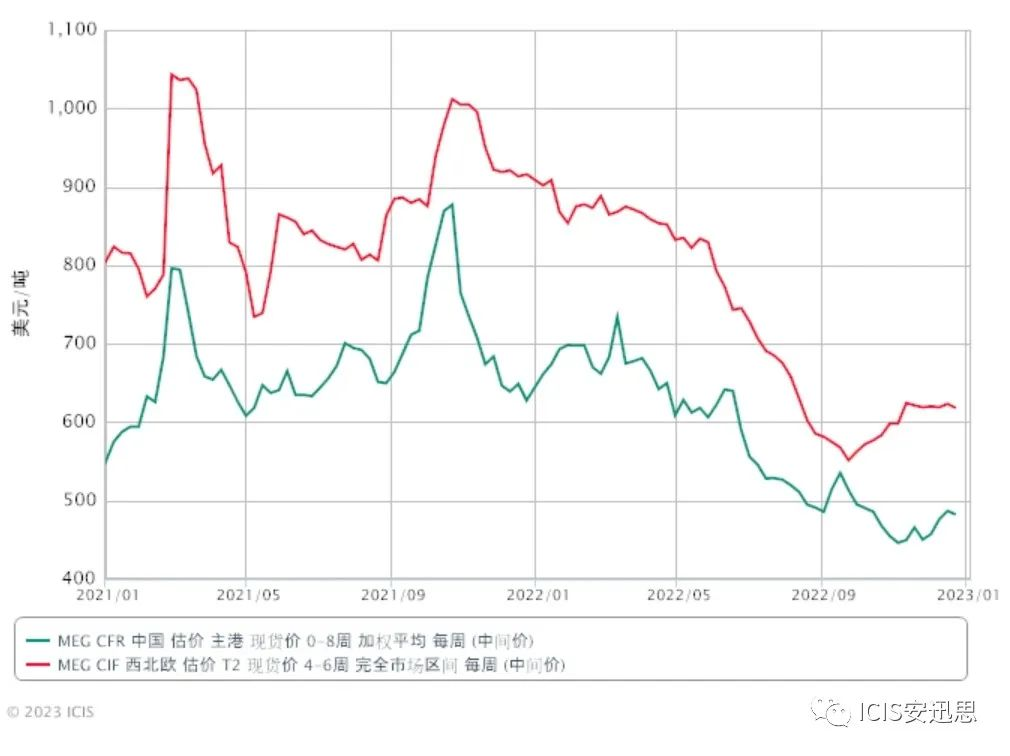

In the first half of 2022, the domestic ethylene glycol market will fluctuate in the game of high cost and low demand. In the context of the conflict between Russia and Ukraine, the price of crude oil continued to soar in the first half of the year, leading to the soaring price of raw materials and the widening price gap between naphtha and ethylene glycol.

Although under the pressure of cost, most ethylene glycol factories have lightened their burden, the continued prevalence of the COVID-19 epidemic has led to significant contraction of terminal demand, continued weakness in ethylene glycol demand, continued accumulation of port inventory, and a new year high. The price of ethylene glycol fluctuated in the game between cost pressure and weak supply and demand, and basically fluctuated between 4500-5800 yuan/ton in the first half of the year. With the continuous fermentation of the global economic recession crisis, the price fluctuation of crude oil futures has decreased, and the cost side support has weakened. However, the demand for downstream polyester continued to be sluggish. With the pressure of funds, the ethylene glycol market intensified its decline in the second half of the year, and the price repeatedly hit new lows in the year. At the beginning of November 2022, the lowest price fell to 3740 yuan/ton.

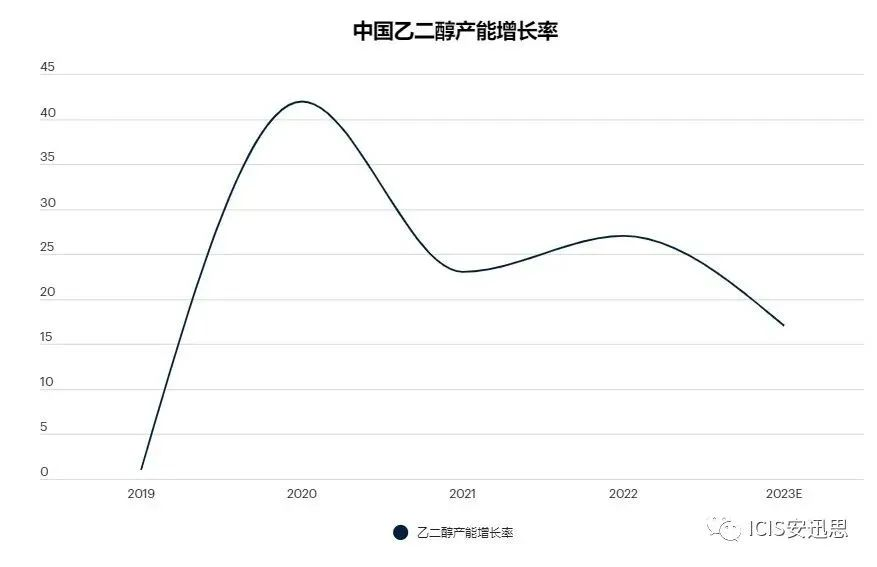

Steady launch of new production capacity and incremental domestic supply

Since 2020, China’s ethylene glycol industry has entered a new production expansion cycle. Integrated devices are the main force for the growth of ethylene glycol production capacity. However, in 2022, the production of integrated units will be mostly postponed, and only Zhenhai Petrochemical Phase II and Zhejiang Petrochemical Unit 3 will be put into operation. The production capacity growth in 2022 will mainly come from coal plants.

By the end of November 2022, China’s ethylene glycol production capacity has reached 24.585 million tons, a year-on-year increase of 27%, including about 3.7 million tons of new coal production capacity.

According to the market monitoring data of the Ministry of Commerce, from January to November 2022, the daily price of electric coal across the country will remain within the range of 891-1016 yuan/ton. The coal price fluctuated significantly in the first half of the year, and the trend was flat in the second half.

Geopolitical risks, the COVID-19 and the monetary policy of the Federal Reserve dominated the strong impact of international crude oil in 2022. Affected by the relatively mild trend of coal prices, the economic benefits of coal glycol should be improved, but the actual situation is not optimistic. Due to weak demand and the impact of centralized online production of new capacity this year, the operating rate of domestic coal glycol plants fell to about 30% in the third quarter, and the annual operating load and profitability were far lower than market expectations.

The total output of some coal production capacities introduced in the second half of 2022 is limited. Under the premise of stable operation, the pressure on the coal supply side may be further deepened in 2023.

In addition, many new ethylene glycol units are planned to be put into operation in 2023, and it is estimated that the growth rate of ethylene glycol production capacity in China will remain around 20% in 2023.

The international financial institutions predict that the international crude oil price will remain at a high level in 2023, the pressure of high costs will still exist, and the starting load of ethylene glycol may be difficult to increase, which will limit the growth of domestic supply to a certain extent.

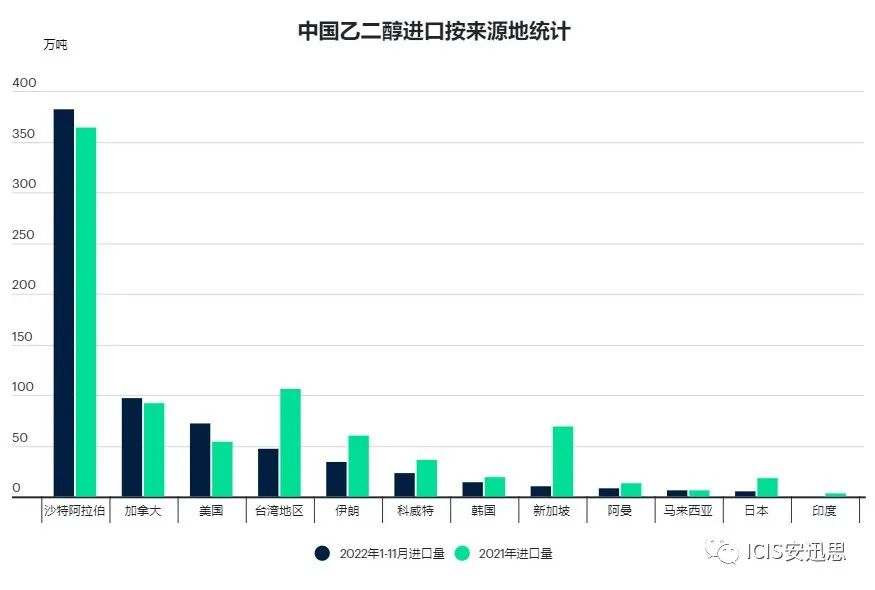

It is difficult to increase the import volume, and import dependence or further decline

From January to November 2022, China’s ethylene glycol import volume will be 6.96 million tons, 10% lower than the same period last year.

Look carefully at the import data. Except Saudi Arabia, Canada and the United States, the import volume of other import sources has declined. The import volume of Taiwan,

Singapore and other places dropped significantly.

On the one hand, the decline in imports is due to the cost pressure, and most of the equipment began to decline. On the other hand, due to the continuous downturn in Chinese prices, suppliers’ enthusiasm for exporting to China has dropped sharply. Third, due to the weakness of China’s polyester market, equipment commencement declined, and the demand for raw materials weakened.

In 2022, China’s dependence on ethylene glycol imports will decline to 39.6%, and it is expected to further decline in 2023.

It is reported that OPEC+may continue to reduce production later, and the supply of raw materials in the Middle East will still be insufficient. Under the pressure of cost, the construction of foreign ethylene glycol plants, especially those in Asia, is difficult to improve significantly. In addition, suppliers will still give priority to other regions. It is said that some suppliers will reduce their contracts with Chinese customers during the contract negotiation in 2023.

In terms of new production capacity, India and Iran plan to launch the market at the end of 2022 and the beginning of 2023. India’s production capacity is still mainly supplied locally, and the particularity of Iran’s equipment import to China may be relatively limited.

Weak demand in Europe and the United States restricts export opportunities

According to data from ICIS supply and demand database, from January to November 2022, China’s ethylene glycol export volume will be 38500 tons, down 69% compared with the same period last year.

Looking closely at the export data, in 2022, China increased its exports to Bangladesh, and by 2021, the exports of Europe and Türkiye, the main export destinations, will decline significantly. On the one hand, due to the overall weakness of overseas demand, on the other hand, due to the tight transportation capacity, the freight is high.

With the further expansion of China’s equipment, it is imperative to go out of castration. With the easing of congestion and the increase of transportation capacity, the freight rate may continue to decline in 2023, which will also benefit the export market.

However, when the global economy enters a recession cycle, the demand of Europe and the United States may be difficult to improve significantly and continue to restrict China’s ethylene glycol exports. Chinese sellers need to look for export opportunities in other emerging regions.

Demand growth rate is lower than supply

In 2022, the new capacity of polyester will be about 4.55 million tons, with a year-on-year growth of about 7%, which is still dominated by the expansion of leading polyester enterprises. It is reported that many equipment originally planned to be put into production this year have been delayed.

The overall situation of polyester market in 2022 is not satisfactory. The continuous outbreak of the epidemic has a significant impact on the terminal demand. The weak domestic demand and export has made the polyester plant overwhelmed. The commencement of the project is far lower than the same period last year.

In the current economic environment, market participants lack confidence in demand recovery. Whether new polyester capacity can be put into operation on time is a big variable, especially for some small equipment. In 2023, the new polyester capacity may remain at 4-5 million tons/year, and the capacity growth rate may remain at about 7%.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Jan-06-2023