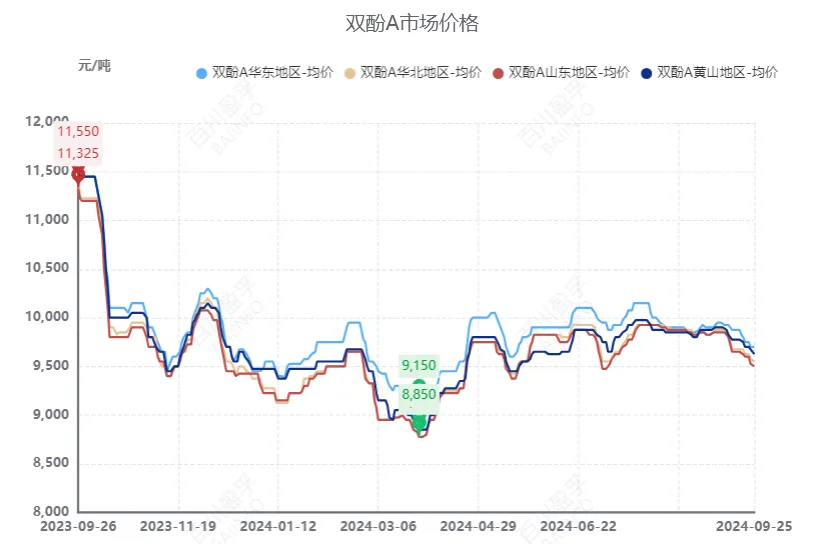

1、 Market price fluctuations and trends

In the third quarter of 2024, the domestic market for bisphenol A experienced frequent fluctuations within the range, and eventually showed a bearish trend. The average market price for this quarter was 9889 yuan/ton, an increase of 1.93% compared to the previous quarter, reaching 187 yuan/ton. This fluctuation is mainly attributed to the weak demand during the traditional off-season (July and August), as well as the increased periodic shutdowns and maintenance in the downstream epoxy resin industry, resulting in limited market demand and manufacturers facing difficulties in shipping. Despite high costs, the industry’s losses have intensified, and there is limited room for suppliers to make concessions. Market prices frequently fluctuate within the range of 9800-10000 yuan/ton in East China. Entering the “Golden Nine”, the reduction in maintenance and the increase in supply have further exacerbated the situation of oversupply in the market. Despite cost support, the price of bisphenol A is still difficult to stabilize, and the phenomenon of sluggish peak season is obvious.

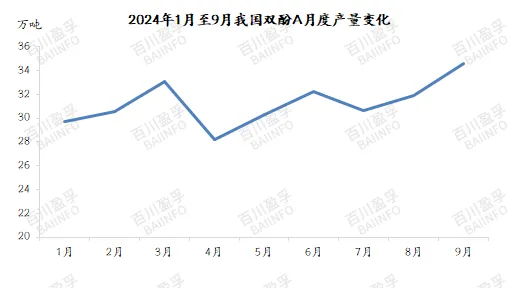

2、 Capacity expansion and output growth

In the third quarter, the domestic production capacity of bisphenol A reached 5.835 million tons, an increase of 240000 tons compared to the second quarter, mainly from the commissioning of the Huizhou Phase II plant in southern China. In terms of production, the output in the third quarter was 971900 tons, an increase of 7.12% compared to the previous quarter, reaching 64600 tons. This growth trend is attributed to the dual effects of new equipment being put into operation and reduced equipment maintenance, resulting in a continuous increase in domestic bisphenol A production.

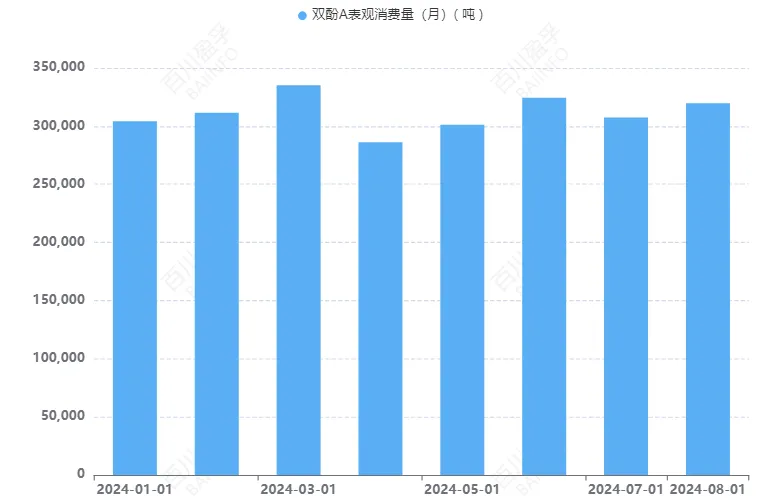

3、 Downstream industries are starting to increase production

Although no new production capacity was put into operation in the third quarter, the operating loads of downstream PC and epoxy resin industries have increased. The average operating load of the PC industry is 78.47%, an increase of 3.59% compared to the previous period; The average operating load of the epoxy resin industry is 53.95%, an increase of 3.91% month on month. This indicates that the demand for bisphenol A in the two downstream industries has increased, providing some support for market prices.

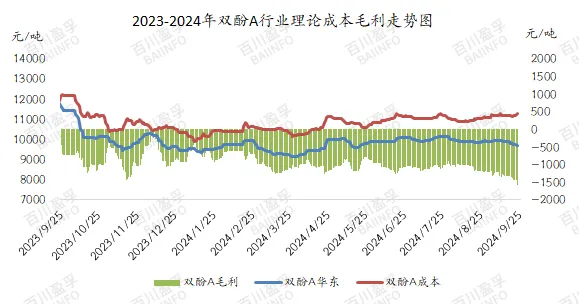

4、 Increased cost pressure and industry losses

In the third quarter, the theoretical average cost of bisphenol A industry increased to 11078 yuan/ton, a month on month increase of 3.44%, mainly due to the rise in raw material phenol prices. However, the industry average profit has dropped to -1138 yuan/ton, a decrease of 7.88% compared to the previous period, indicating enormous cost pressure in the industry and further deterioration of the loss situation. Although the decline in the price of raw material acetone has been offset, the overall cost is still not conducive to industry profitability.

5、 Market forecast for the fourth quarter

1) Cost outlook

It is expected that in the fourth quarter, there will be less maintenance of the phenol ketone factory, and coupled with the arrival of imported goods at the port, the supply of phenol in the market will increase, and there is a possibility of price decline. The acetone market, on the other hand, is expected to experience a low range adjustment in price due to abundant supply. The changes in the supply of phenolic ketones will dominate the market trend and exert certain pressure on the cost of bisphenol A.

2) Supply side forecast

There are relatively few maintenance plans for domestic bisphenol A plants in the fourth quarter, with only a small number of maintenance arrangements in Changshu and Ningbo areas. At the same time, there are expectations for the release of new production capacity in Shandong region, and it is expected that the supply of bisphenol A will remain abundant in the fourth quarter.

3) Outlook on demand side

The maintenance operations in downstream industries have decreased, but the epoxy resin industry is affected by supply and demand contradictions, and production is expected to remain at a relatively low level. Although there are expectations for new equipment to be put into operation in the PC industry, attention should be paid to the actual production progress and the impact of maintenance plans on the operating load. Overall, downstream demand is unlikely to experience significant growth in the fourth quarter.

Based on a comprehensive analysis of cost, supply, and demand, it is expected that the bisphenol A market will operate weakly in the fourth quarter. The cost support has weakened, supply expectations have increased, and downstream demand is difficult to significantly improve. The industry’s loss situation may continue or even intensify. Therefore, it is necessary to closely monitor unplanned load reduction and maintenance operations within the industry to cope with potential market volatility risks.

Post time: Sep-26-2024