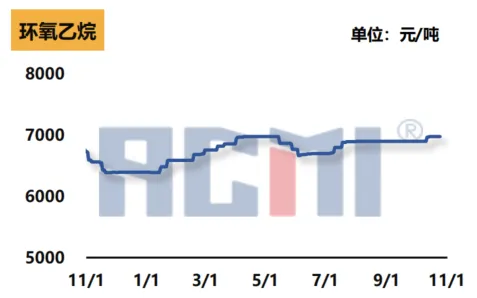

1、 Ethylene oxide market: price stability maintained, supply-demand structure fine tuned

Weak stability in raw material costs: The price of ethylene oxide remains stable. From a cost perspective, the raw material ethylene market has shown weak performance, and there is insufficient support for the cost of ethylene oxide. The weak stability of ethylene prices directly affects the cost structure of ethylene oxide.

Tightening on the supply side: On the supply side, Yangzi Petrochemical’s shutdown for maintenance has led to a tight supply of goods in the East China region, resulting in a tight shipping pace. At the same time, Jilin Petrochemical is increasing its load, but the downstream receiving rhythm is gradually increasing, and the overall supply is still showing a trend of shrinking.

Downstream demand slightly decreases: On the demand side, the main downstream polycarboxylate superplasticizer monomer operating load has decreased, and the demand support for ethylene oxide has loosened due to the short-term shutdown adjustment of the East China raw material and monomer units.

2、 Palm oil and medium carbon alcohol market: price increase, cost driven significant

Palm oil spot price rise: Last week, the spot price of palm oil significantly increased, bringing cost pressure to the related industry chain.

The price of medium carbon alcohols is driven by raw materials: the price of medium carbon alcohols has risen again, mainly due to the increase in the price of raw material palm kernel oil. As a result, the cost of fatty alcohols has been driven up, and manufacturers have raised their offers one after another.

The high carbon alcohol market is deadlocked: the price of high carbon alcohol in the market is stabilizing. Despite the continuous rise in prices of raw materials such as palm oil and palm kernel oil, the market supply is limited, and downstream manufacturers have increased their enthusiasm for inquiries. However, actual transactions are still insufficient, and the market supply and demand are in a stalemate.

3、 Non ionic surfactant market: price increase, release of demand for daily chemical stocking

Cost increase: The non-ionic surfactant market rose last week, mainly due to the sustained increase in the prices of raw fatty alcohols. Although the price of ethylene oxide remains stable, the rise in fatty alcohols has driven the overall market upward.

Stable supply: In terms of supply, the factory mainly delivers early orders, and the overall supply is relatively stable.

Downstream demand cautious: On the demand side, with the approaching of “Double Eleven”, some stocking orders in the downstream daily chemical industry have been released one after another, but downstream procurement remains cautious and generally active due to the impact of high prices.

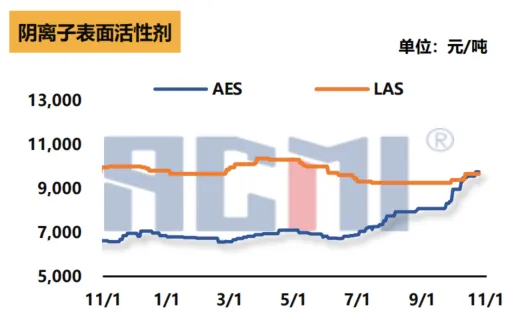

4、 Anionic surfactant market: rising prices, tight supply in South China

Cost support: The main driving force behind the price increase of anionic surfactants comes from the rise in raw material fatty alcohols. The continuous rise in the price of fatty alcohols continues to support the AES watch market.

Increased cost pressure on factories: On the supply side, factory offers are firm, but due to high prices of fatty alcohols, factory cost pressure has increased. The supply of AES in the South China region is slightly tight.

Downstream demand gradually released: On the demand side, as the “Double Eleven” shopping festival approaches, downstream demand is gradually released, but new orders signed this week are limited and mostly in small quantities.

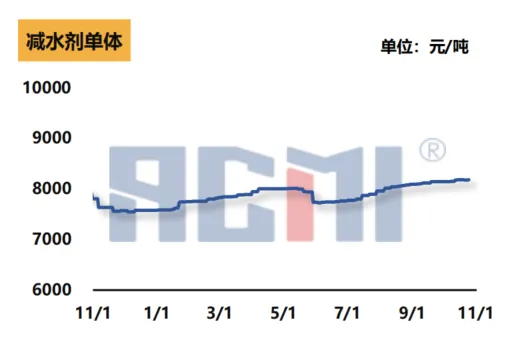

5、 Polycarboxylate water reducing agent monomer market: Strong operation, reduced raw material supply

Cost support enhancement: The market for polycarboxylate superplasticizer monomers was relatively strong last week. On the cost side, due to the short-term shutdowns of Satellite Petrochemical and Yangtze Petrochemical, the supply of ethylene oxide in the region has decreased, supporting the cost of individual units.

Shortage of spot resources: In terms of supply, some facilities in East China are under maintenance, and spot resources are relatively tight. Due to a slight shortage of raw material resources, some factories have reduced their individual operating loads.

Downstream demand wait-and-see: On the demand side, due to the impact of cold weather, the pace of terminal construction has slowed down from north to south. Downstream rigid demand has become mainstream, and the market is waiting for further demand release.

The performance of various sub sectors in the chemical industry varies, but is generally affected by fluctuations in raw material prices, adjustments in supply and demand structure, and seasonal factors.

Post time: Oct-30-2024