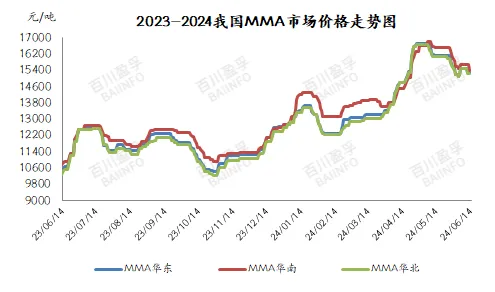

1、 Market Overview and Price Trends

In the first half of 2024, the domestic MMA market experienced a complex situation of tight supply and price fluctuations. On the supply side, frequent device shutdowns and load shedding operations have led to low operating loads in the industry, while international device shutdowns and maintenance have also exacerbated the shortage of domestic MMA spot supply. On the demand side, although the operating load of industries such as PMMA and ACR has fluctuated, the overall market demand growth is limited. In this context, MMA prices have shown a significant upward trend. As of June 14th, the average market price has increased by 1651 yuan/ton compared to the beginning of the year, with an increase of 13.03%.

2、 Supply analysis

In the first half of 2024, China’s MMA production increased significantly compared to the same period last year. Despite frequent maintenance operations, the 335000 ton unit put into operation last year and the 150000 ton unit expanded in Chongqing have gradually resumed stable operation, resulting in an increase in total production capacity. Meanwhile, the expansion of production in Chongqing has further increased the supply of MMA, providing strong support for the market.

3、 Requirement analysis

In terms of downstream demand, PMMA and acrylic lotion are the main application fields of MMA. In the first half of 2024, the average starting load of PMMA industry will slightly decrease, while the average starting load of acrylic lotion industry will increase. The asynchronous changes between the two have resulted in limited overall improvement in MMA demand. However, with the gradual recovery of the economy and the stable development of downstream industries, it is expected that MMA demand will maintain stable growth.

4、 Cost profit analysis

In terms of cost and profit, MMA produced by C4 process and ACH process showed a trend of cost decrease and gross profit increase in the first half of the year. Among them, the average production cost of C4 method MMA slightly decreased, while the average gross profit increased significantly by 121.11% year-on-year. Although the average production cost of ACH method MMA has increased, the average gross profit has also increased significantly by 424.17% year-on-year. This change is mainly due to the broad increase in MMA prices and limited cost concessions.

5、 Import and export analysis

In terms of imports and exports, in the first half of 2024, the number of MMA imports in China decreased by 25.22% year-on-year, while the number of exports increased by 72.49% year-on-year, nearly four times the number of imports. This change is mainly due to the increase in domestic supply and the lack of MMA spot in the international market. Chinese manufacturers have seized the opportunity to expand their export volume and further increased MMA’s export share.

6、 Future prospects

Raw material: In the acetone market, special attention needs to be paid to the import arrival situation in the second half of the year. In the first half of the year, the import volume of acetone was relatively small, and due to unexpected situations in foreign equipment and routes, the arrival volume in China was not high. Therefore, caution should be taken against the concentrated arrival of acetone in the second half of the year, which may have a certain impact on market supply. At the same time, the product operation of MIBK and MMA also needs to be closely monitored. The profitability of both companies was good in the first half of the year, but whether they can continue will directly affect the valuation of acetone. It is expected that the average market price of acetone in the second half of the year may remain between 7500-9000 yuan/ton.

Supply and demand side: Looking ahead to the second half of the year, there will be two new units put into operation in the domestic MMA market, namely the C2 method 50000 tons/year MMA unit of a certain enterprise in Panjin, Liaoning and the ACH method 100000 tons/year MMA unit of a certain enterprise in Fujian, which will increase the MMA production capacity by a total of 150000 tons. However, from the perspective of downstream demand, the expected fluctuations are not significant, and the production capacity growth rate on the demand side is relatively slow compared to the supply growth rate of MMA.

Price trend: Taking into account the raw material, supply and demand, as well as domestic and international market conditions, it is expected that the probability of MMA prices continuing to rise sharply in the second half of the year is not high. On the contrary, as supply increases and demand remains relatively stable, prices may gradually fall back to a reasonable range of fluctuations. It is expected that the price of MMA in the East China market in China will be between 12000 to 14000 yuan/ton in the second half of the year.

Overall, although the MMA market is facing certain supply pressures, the stable growth of downstream demand and the linkage between domestic and international markets will provide strong support for it.

Post time: Jun-18-2024